GT Group, a North East manufacturer and supplier of engine air and emission control systems, has completed a management buyout, providing an exit for private equity firm Rcapital.

Rcapital initially acquired GT Group, based in County Durham, in January 2025 after it was carved out from German firm Knorr-Bremse, which had designated the business as non-core. At the time, the company was underperforming.

Since the acquisition, Rcapital has worked closely with GT Group’s management team to transform operations. The business is now reporting strong profit margins and anticipates significant growth over the next two years.

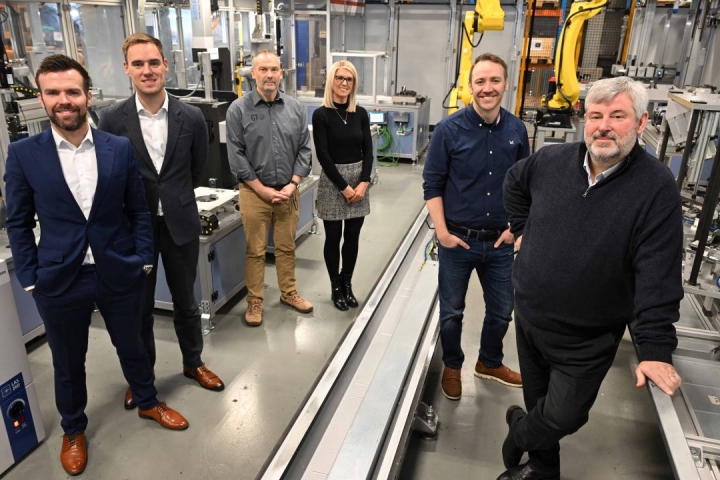

The management buyout was led by managing director Steve Wright, finance director Ian Black, HR director Kelly Kean, and commercial and technical sales director Dean Machnicki. Funding for the transaction was provided by Cynergy Bank through a range of facilities.

Founded in the 1970s by North East entrepreneur Geoff Turnbull, GT Group has become a leading supplier of engine air valve systems for medium- and heavy-duty commercial vehicles and off-highway equipment. Its customer base includes global manufacturers such as Daimler, Volvo, Scania, JCB, MAN, and John Deere.

The company employs more than 180 people at its Peterlee facility and has additional manufacturing capability in India to support international exports. GT Group generates revenues of over £40 million.

Steve Wright said: “Today’s announcement marks an exciting new chapter in GT Group’s history as we transition from private equity ownership back to private ownership in the North East. We look forward to continuing the growth of the business and would like to thank the Rcapital team for all their support over the last 12-months and for allowing us the opportunity to return the business to local ownership.”

Andy Dalton of Rcapital added: “Collectively, we have achieved so much in our ownership of GT Group, returning the business to its proud heritage of being a leading business in the North East. Working with management we have achieved a successful transformation significantly ahead of expectations, which means the time is right for us to allow the management team to take the business forward. We wish Steve and all of the wider GT team the very best for the exciting future ahead.”

Rcapital was advised on the transaction by Interpath Advisory and Browne Jacobson, while the management team received advice from RG Corporate Finance and Mincoffs Solicitors. Cynergy Bank was advised by Shoosmiths.